How generative AI is reshaping brand and product discovery

Brands in finance, insurance, and healthcare should treat AI platforms as the new battleground for customer mindshare.

Husain Mohsin

Author

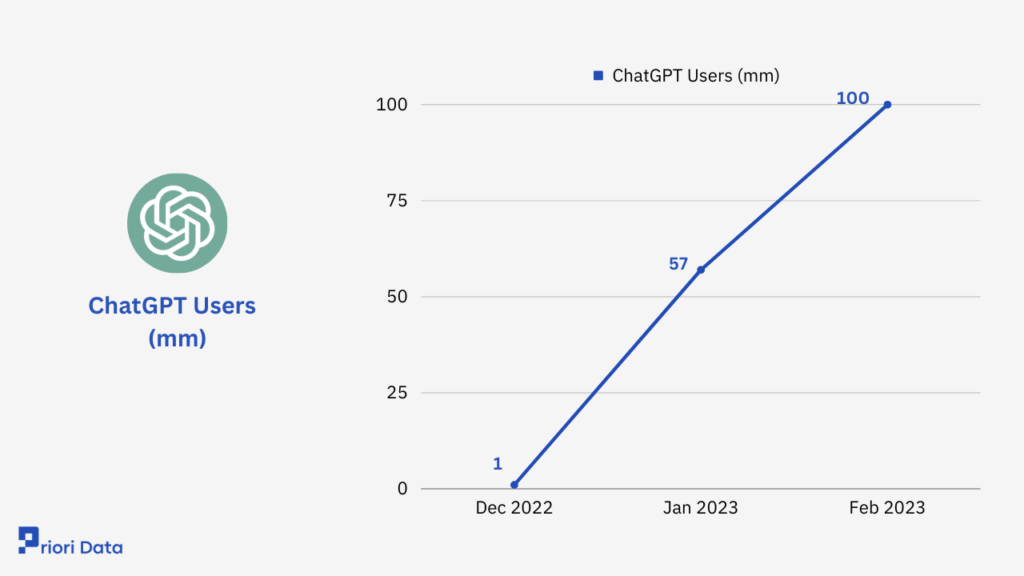

In a recent report from Adobe Analytics, search traffic to US retail websites from Generative AI sources has jumped 1,200%. Generative AI has moved from novelty to a mainstream tool that millions now use to find information – including recommendations on brands, services, and products. ChatGPT reached 1 million users in just five days and now draws over 400 million monthly users, illustrating how rapidly consumers have embraced AI assistants. This surge is massively disrupting how people search and discover products online.

Crucially, it’s not just Google’s realm anymore: users are turning to conversational AI platforms like OpenAI’s ChatGPT, Google’s upcoming Gemini, Meta’s Llama 2, and even Amazon’s new “Rufus” AI assistant for shopping. In regulated sectors such as finance, insurance, and healthcare – where trust and accurate information are paramount – generative AI is already transforming how consumers find and evaluate offerings.

One notable change is that the buying journey is becoming an interactive conversation . Instead of performing one-off searches, consumers are engaging in extended back-and-forth dialogues with AI chatbots throughout the buying funnel. As one industry expert observes, shoppers are now having “a series of questions through the entire customer journey or purchase funnel” with AI, rather than a single query-and-click – an iterative conversation that guides their decisions step by step. For example, a consumer might start by asking a chatbot which product category fits their needs, then inquire about specific features, compare alternatives, and finally confirm the best choice. This conversational approach keeps the AI assistant “between the brand and the individual, basically guiding the conversation about the product” as the consumer moves toward a purchase. In practical terms, an AI assistant can educate the buyer on product specs, clarify usage questions, and even handle objections in real time, much like a personal shopping advisor available 24/7.

Recent upgrades (late 2024– early 2025)

Many of the consumer-facing AI tools got significant improvements in 2024–2025 that make them even more useful for product research and recommendations:

- OpenAI ChatGPT Gets Web Browsing & Plugins (2024): Originally, ChatGPT’s knowledge cut off in 2021, limiting its usefulness for new products. In 2024, OpenAI re-enabled and enhanced ChatGPT’s web browsing capability , allowing it to pull current information from the internet when needed. This means ChatGPT can now fetch the latest data – for instance, 2024’s newest insurance plans or current interest rates – instead of relying solely on its training data. OpenAI also expanded the plugin ecosystem, which includes plugins for shopping (e.g. Instacart, Klarna) that let ChatGPT search product databases in real time. These upgrades make ChatGPT far more adept at product discovery tasks , from finding up-to-date prices to checking if a particular item is in stock or if a new financial product has launched.

-

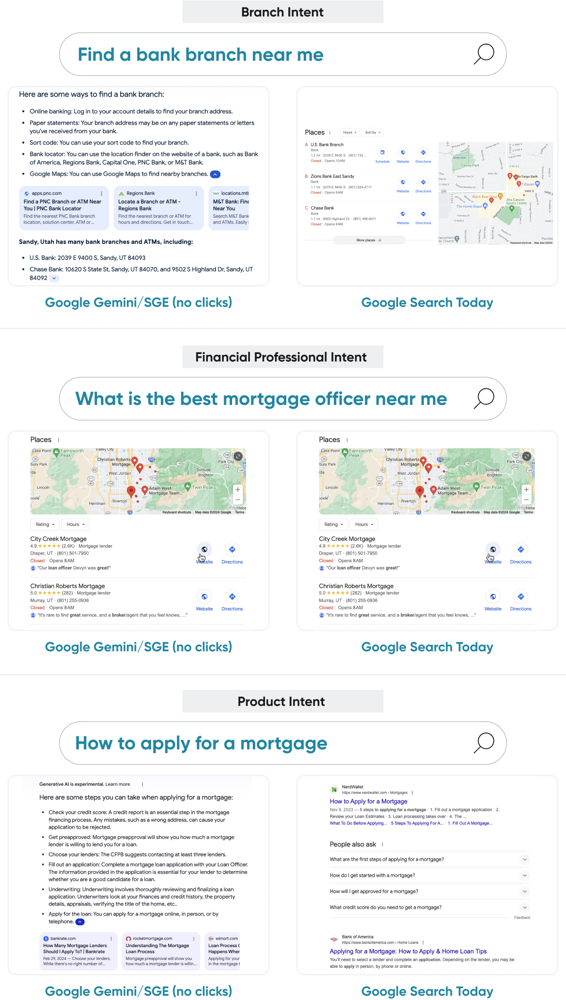

Google’s Gemini AI integrated into Search (late 2024):

Google’s next-gen LLM

Gemini

(the successor to PaLM 2) was custom-built to enhance search. By late 2024, Google confirmed that Gemini is being used to generate richer answers in SGE. Gemini’s multimodal and reasoning abilities allow it to handle more complex queries. At Google I/O 2024, the company demonstrated how AI could answer entirely new types of questions that search engines struggled with before. For example, you can describe an intricate need (“I need a gift for a 10-year-old who loves astronomy and dinosaurs”) and the AI can parse that and suggest creative product ideas. In 2025, Google also expanded

AI summaries to more healthcare queries

and introduced features like comparative overlays for medical information, showing their commitment to domain-specific improvements. All these updates aim to make the AI results more accurate, comprehensive, and trustworthy – critical for regulated fields.

-

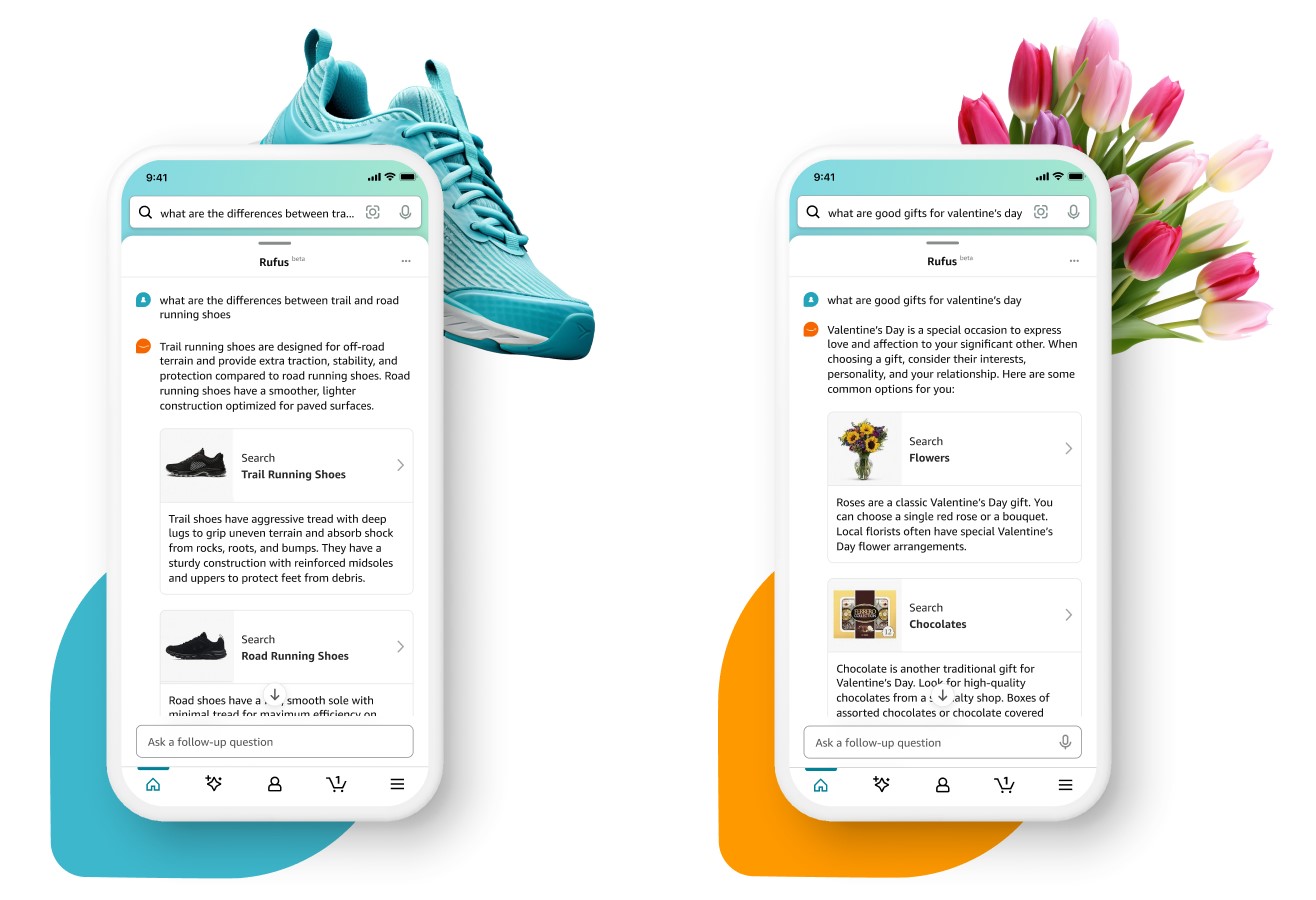

Amazon’s Rufus Fully Deployed (2024):

After a testing period,

Amazon’s Rufus shopping AI was rolled out to all US customers in September 2024

. Throughout 2024, Amazon improved Rufus’s ability to handle a broad range of shopping questions. By analyzing

product manuals, customer reviews, and even community Q&A content

, Rufus became better at answering detailed product questions (e.g. compatibility concerns, ingredient safety in cosmetics). Amazon also reports refining Rufus with feedback from

tens of millions of customer interactions

. This feedback loop helped the AI provide more relevant recommendations. For instance, if users frequently ask whether a certain mascara is a “clean beauty” product, Rufus learns to proactively mention product safety or ingredient info. By 2025, Amazon predicts its AI assistant will significantly boost customer engagement and sales – an internal projection even estimated a

$700M profit impact

from Rufus, as more shoppers find what they need faster.

- Perplexity AI and Others – Enhanced Answer Engines: Smaller AI search players continued to innovate. Perplexity introduced features like “internal knowledge search” and community sharing (Spaces) in late 2024 . These allow users to trust it not just for public web info but also for personal or proprietary data (think of uploading a PDF of your insurance policy and asking questions about it). While not specific to one industry, such features can be extremely useful in regulated domains – e.g. a doctor could upload clinical guidelines and have the AI answer questions, or a financial advisor could query an AI on internal research documents. Additionally, Microsoft’s AI Co-pilot integration across Windows and Office (late 2023) means more users have an AI at their fingertips, which could be used to search the web or internal data without opening a browserfile-ckvpyd2l5rg2rkvp7c74dq. Apple is also rebuilding Siri with generative AI capabilitiesfile-ckvpyd2l5rg2rkvp7c74dq – we may soon see voice-driven product queries (like asking your iPhone, “Compare health insurance plans for me” ) become far more fluent and detailed than Siri’s current abilities.

What does this shift mean for regulated brands?

The upshot of these upgrades is that consumers in 2025 expect

fast, personalized answers

from AI, and the AI tools are increasingly able to deliver.

In finance, insurance, and healthcare, consumers are beginning to use these platforms to get answers that were once provided by advisors, agents, or curated search results. Below, we explore specific use cases and implications in these sectors.

Financial Services (Banking & Investment)

Consumers are using AI chatbots to seek quick financial advice and product recommendations in a conversational way. Instead of parsing fine print on bank websites, a user might ask an AI assistant:

“What’s the best savings account for high interest rates?”

or

“How do I apply for a mortgage?”

- Product Comparisons: A generative AI can instantly compare financial products. For example, Google’s AI Overview might summarize “how to apply for a mortgage” with step-by-step guidance and even list AI-generated snippets of the nearest bank branches or loan officers if relevant. Under the new SGE, a query like that yields an AI answer explaining the process, whereas previously a user had to click a bank’s website or a how-to article. In side-by-side tests, the generative result often provides the needed info with zero clicks to external sites. Similarly, asking “Which is better: a 15-year vs 30-year mortgage?” in ChatGPT or Bard can produce a detailed comparison, something that used to require reading several blog posts.

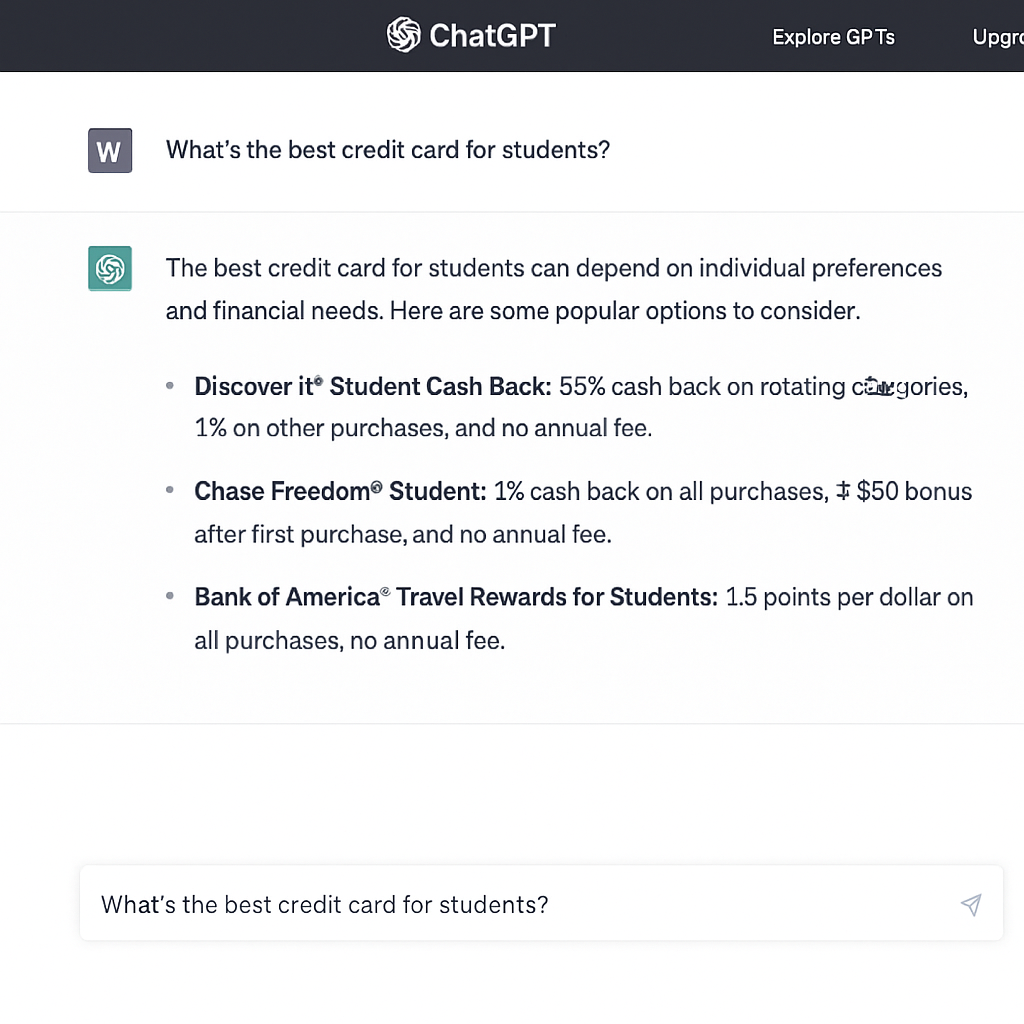

- Credit Cards and Loans: AI assistants are being used to evaluate consumer finance products. A user could query, “Find me the top 3 travel credit cards with low annual fees,” and the AI will likely enumerate a few card options, citing their perks and fees. ChatGPT tends to give very straightforward, advisory answers in finance, and research shows it can even rival traditional robo-advisors in certain advice scenarios (though with caveats). That said, platforms often include disclaimers for financial queries. Forbes analysts warn users not to blindly trust ChatGPT for financial product recommendations yet, as it doesn’t know one’s personal situation. Still, the convenience is attractive – especially for general questions like banking terminology, how to open an account, or comparing interest rates.

- Personal Finance Guidance: Beyond specific products, generative AI can educate consumers on financial strategies. For instance, people are asking ChatGPT things like “How can I improve my credit score?” or “What’s a 401(k) and should I use one?” and getting digestible answers. This may not point them to a particular brand immediately, but it shapes their criteria for later choosing a provider (e.g. learning that low-fee investment funds are good, so they then seek brands offering those). Banks and investment firms are starting to notice this indirect influence on customers’ decisions. Some institutions have begun integrating AI chat on their own sites to answer customer queries with approved information, hoping to keep the user from going out to a third-party AI which might give mixed results.

Insurance

Insurance products are complex and often not well understood by consumers – a perfect scenario for AI guidance. Users are beginning to lean on generative AI to demystify policies and providers:

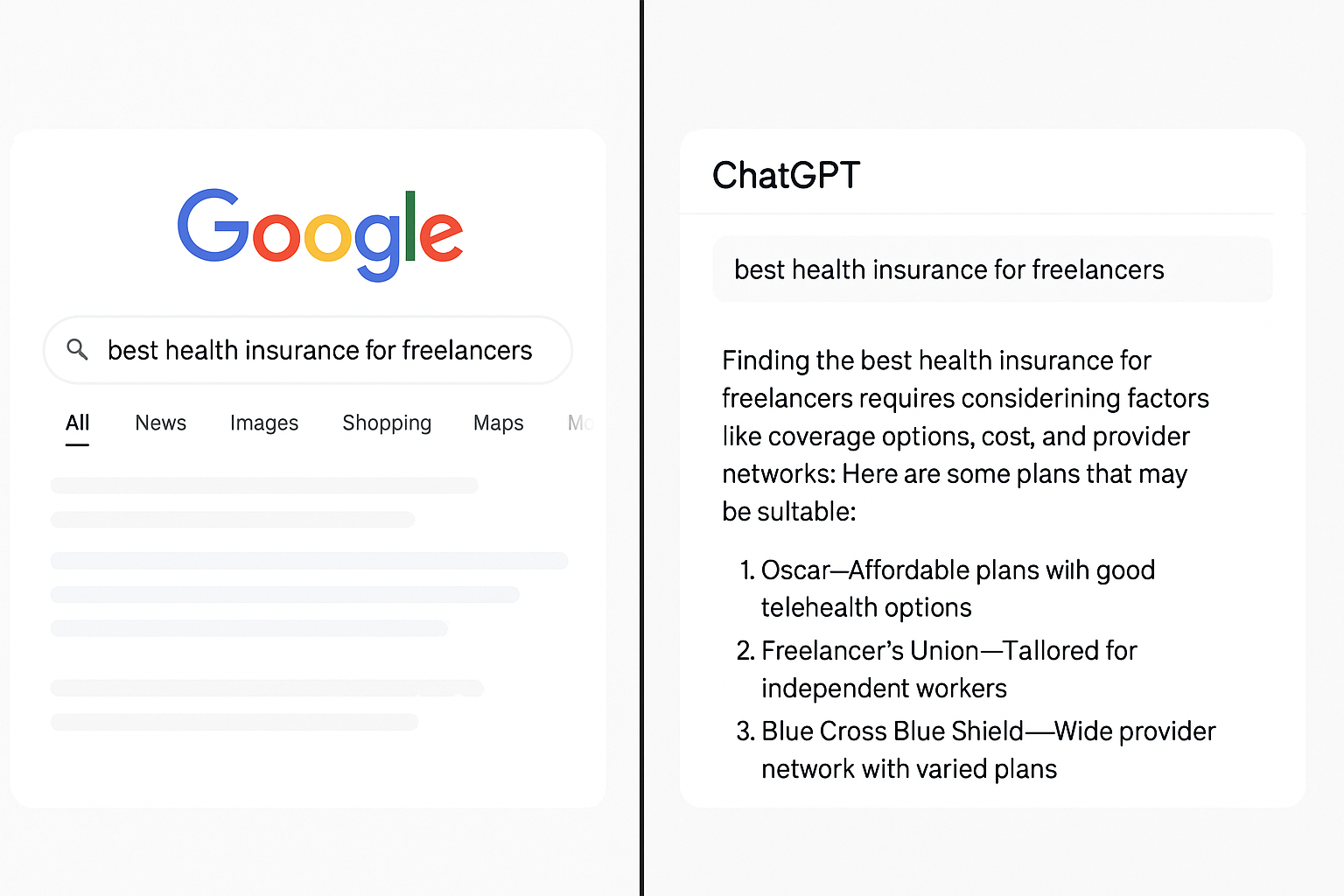

- Product recommendation: Rather than calling an insurance agent, someone might ask an AI, “What insurance do I need as a freelancer?” The assistant could outline necessary coverage (health, disability, liability, etc.) and even list popular insurers or plans that fit the profile. Early experiments with AI search in insurance show a “high impact” of generative answers on this sector’s queries – meaning many insurance-related searches yield an AI summary. For example, a query about “best car insurance for new drivers” might prompt an AI to list a few insurers known for good youth driver rates, summarizing each. These answers typically draw from online reviews, consumer surveys, and state insurance filings (data that AI can ingest from its training).

- Complex coverage questions: Insurance is filled with “it depends” scenarios, and AI chat is surprisingly adept at handling these nuances through conversation. A user could ask, “Does my travel insurance cover trip cancellation due to illness?” and get a tailored explanation, possibly followed by “What are some insurers that offer robust trip cancellation coverage?” The AI might cite a few top-rated plans. In the past, the user would have to read policy PDFs or trust an agent; now the AI acts as an initial filter and educator . Of course, it may not know the specifics of your policy unless you feed it, but it can speak generally.

- Local and niche insurance info: Generative AI in search also affects how local insurance providers get discovered. If someone searches “Best home insurance in Florida” , Google’s AI overview could aggregate data about insurers in that region (hurricanes coverage, customer satisfaction, rates) from various sources. In Google’s new AI-powered search, the results may highlight different providers with AI-generated descriptions rather than the usual list of web pages , depending on query intent. Likewise, ChatGPT might not give a local agency name offhand (since its training data skews to larger entities), but as these models integrate real-time data, even smaller insurers with strong local reviews could surface via AI recommendations.

Insurance being highly regulated means any incorrect answer about coverage can be risky. The AI platforms usually have safeguards, but mistakes can happen (e.g. misunderstanding a coverage clause). Still, consumers appear eager to use these tools for quick answers, and insurers are beginning to incorporate vetted AI bots in customer service. We are likely to see more specialized insurance chatbots (trained on policy wordings and state regulations) that plug into bigger assistant platforms.

Healthcare

Healthcare is one of the most impacted industries in this AI search revolution – analysts found that healthcare queries see “extreme” levels of AI-generated answers in Google’s SGE , more than any other category. Both patients and providers are using generative AI to find medical information, which directly influences healthcare brand discovery (hospitals, clinics, medications, etc.):

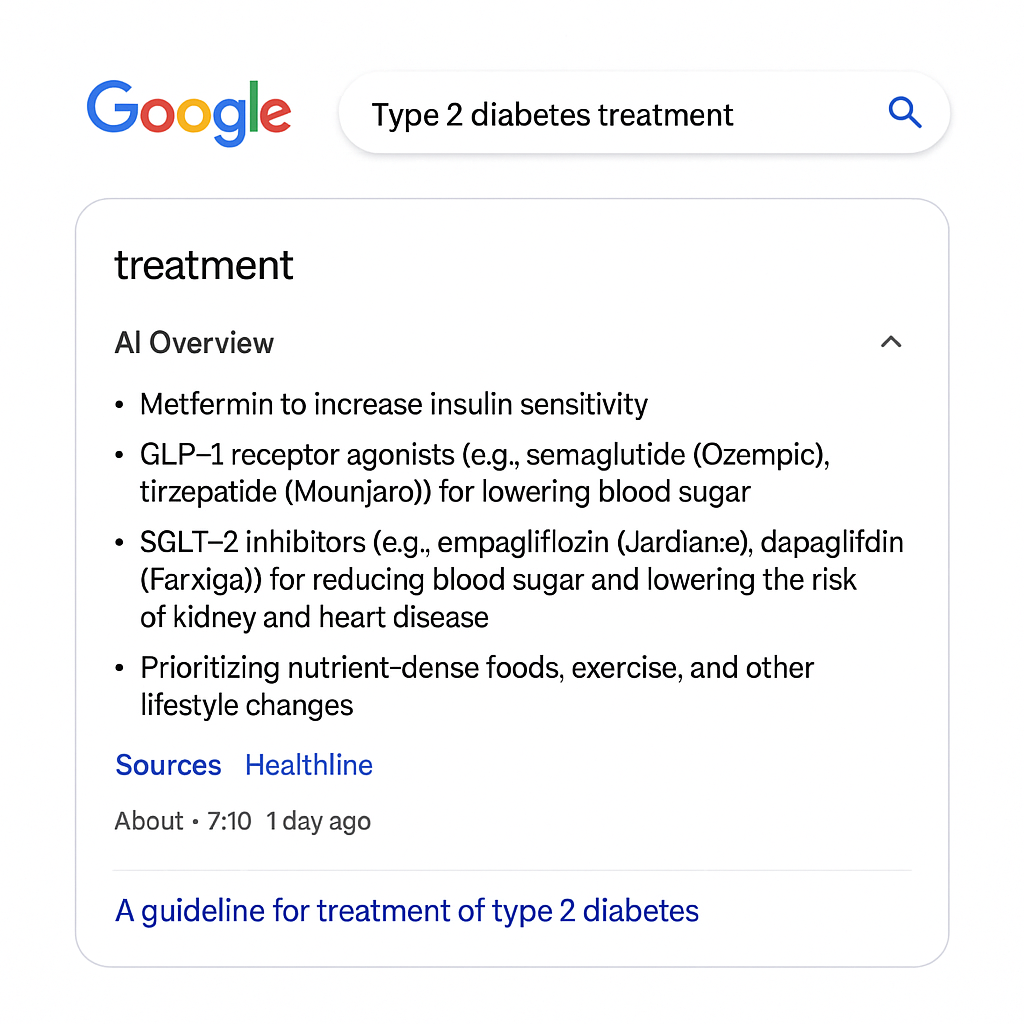

- Symptom and treatment searches: Patients often search symptoms or treatment options before deciding on care. Now, asking an AI, “How is Type 2 diabetes treated?” might yield an organized answer describing diet, exercise, medications (with drug brand names), and possibly mention leading healthcare providers or programs. Google recently announced it is expanding AI summaries to thousands more health topics – for instance, a search about a chronic condition could show an AI-crafted overview with medical facts and even patient anecdotes . One new feature called “What People Suggest” uses generative AI to compile snippets of online patient discussions for those with similar diagnoses. So if you search a specific condition, you might see common tips from other patients (e.g. “Others with arthritis suggest these exercises” ). This kind of crowd-sourced summary was never available in traditional search, and it can influence which treatments or wellness products a patient considers.

- Health Product Recommendations: Consumers also use AI to discover health-related products (supplements, medical devices, insurance plans). For example, “What’s a good over-the-counter allergy medicine that won’t cause drowsiness?” could get an answer listing a couple of antihistamine brands with rationale. Or someone might ask, “Which fitness tracker is best for heart health monitoring?” and get a comparison of wearables. These are effectively product discovery questions that now bypass traditional search ads and review sites. The AI will glean from reviews, specifications, and expert articles to present a few options. Given the sensitivity around medical advice, platforms like Bard and ChatGPT usually couch suggestions with caution ( “Consult a healthcare professional… ”), but they often do provide substantive info that can lead a user toward certain brands or solutions.

Google’s own data showed a heavy uptake of AI answers in health queries, and it’s actively tuning this feature. For example, Google’s AI can now compare complex health information (like showing side-by-side info on different illnesses or treatments), something that can heavily influence a patient’s perception of treatment options.

Why brands must monitor, track AI-generated results

For brands in finance, insurance, and healthcare, the rise of generative AI in discovery is a double-edged sword: it presents new opportunities to reach customers, but also risks if you’re not represented accurately. AI assistants can become the “source of truth” about your brand for consumers who use them. This makes it vital to actively monitor, measure and track your company or products in AI-driven conversations and search results.

Consider the new customer journey: Instead of clicking your carefully crafted website or a listing you paid for, a consumer might hear about you from an AI’s summary. If the AI says “Policy ABC has slow claim approvals” or “Clinic XYZ is top-rated for cardiac care” , those statements can make or break a customer decision – and they often come with no immediate ability for you to rebut or elaborate (unlike on your own site or social media). Therefore:

- Monitor AI outputs regularly: It’s important to treat AI answers as a new type of “search result” to monitor . Just as companies track their Google search rankings or social media mentions, they should now be checking what ChatGPT, Bing Chat, Bard, etc., say about them. This could mean literally asking the AI, “What is your opinion of [my company]?” or “Which [product type] do you recommend and why?” and seeing if your brand appears and how it’s described. Some AI platforms cite sources – follow those links to see where the information is coming from. If an AI summary cites a years-old article or an inaccurate forum comment, you may need to engage in some PR or content updates to correct the record at the source. Tools will emerge for “AI reputation monitoring,” but even now, manually querying these systems can be eye-opening. Remember, AI models also have training data that may not update instantly with the web – if you changed a policy in 2023 but the AI was trained on 2021 info, it might be telling people outdated details. Knowing this, you might publish fresh content or press releases emphasizing the new info, increasing the chances the AI picks it up when using its browsing or updated models.

- Embrace AI on owned channels: Brands shouldn’t just react to others’ AI – they can deploy their own. Many banks, insurers, and healthcare providers are starting to use GPT-powered chatbots on their websites or apps to guide customers. These can be tuned to provide compliant, up-to-date info and can hand off to human agents when needed. Not only does this improve customer experience, it also feeds the broader AI ecosystem: the more people directly get answers from a brand’s AI (with approved messaging), the less likely they’ll rely on an external AI that might be less accurate. In regulated industries, compliance-approved AI assistants could become a competitive advantage, serving as both a helpful tool and a form of content dissemination (for instance, a user might share “My bank’s chatbot told me X about mortgages” – effectively spreading your narrative).

Brands in finance, insurance, and healthcare should treat AI platforms as the new battleground for customer mindshare. By monitoring AI outputs and adapting strategies accordingly, you can ensure that when an AI agent guides a consumer through a financial decision or health query, your brand is accurately and favorably represented.

In the age of AI-driven search, your next customer might never visit a search engine or your website at all — they might simply ask a chatbot . Preparing for that reality is now mission-critical. Or, as one expert succinctly put it: “Your best customer is an AI bot… If AI doesn’t know your brand exists, consumers won’t either.”

At LemonHQ, we have developed the capability to measure brand representation and tracking for the leading LLMs. Knowing where your brand or product stands in todays AI-enabled landscapes is critical to decision making and staying ahead, request a free AI assessment report of your brand or product here.

Information sources and references

- How AI Fueled Black Friday Shopping This Year

- Adobe Analytics: Traffic to US Retail Websites from Generative AI Sources Jumps 1,200%

- AI search is starting to kill Google’s ‘ten blue links’

- The Future of Product Data: Trends in PXM and Beyond

- Amazon's AI shopping assistant Rufus is projected to indirectly boost operating profits by $700 million this year

- From ‘catch up’ to ‘catch us’: How Google quietly took the lead in enterprise AI

- Google leans further into AI-generated overviews for its search engine

- Perplexity Releases Internal Knowledge Search and Spaces

- target="_blank" Adobe Analytics: GenAI Traffic to Retail Websites Doubles Every 2 Months

- More consumers using genAI tools to research purchases: Adobe