The Challenge

Liva faced major hurdles in scaling its sales channels across direct customers, partners, and brokers. The existing experience was fragmented and inconsistent—separate portals served each segment, creating isolated silos. This setup made it costly and inefficient to roll out new features, offers, or capabilities, as each had to be implemented multiple times across different platforms.

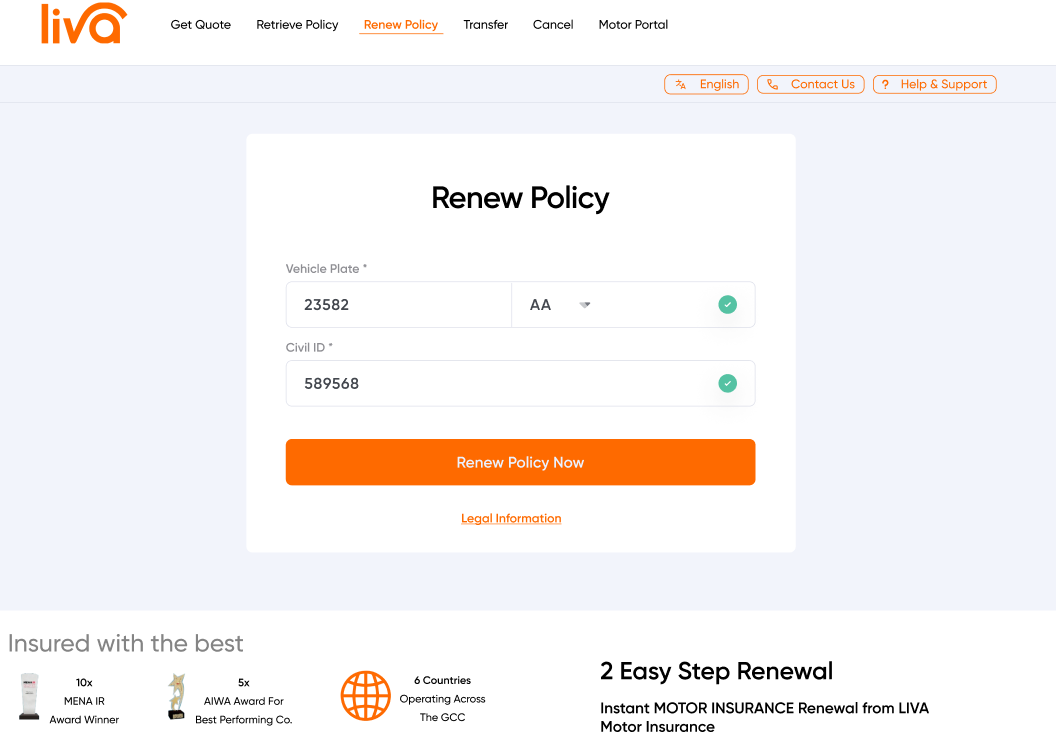

Compounding the challenge was Liva’s overreliance on third-party brokers for renewals. This not only made repeat business unpredictable but also prevented Liva from building direct relationships with policyholders. The lack of first-party data limited the brand’s ability to make informed product or marketing decisions, while customer acquisition remained costly with minimal long-term impact.

For Liva—a multi-line insurer—owning the customer relationship was critical. It was the key to unlocking retention, enabling cross-sell opportunities, and staying ahead of digital-first competitors in an increasingly direct-to-customer market.